FOMC minutes results: Reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities (MBS)

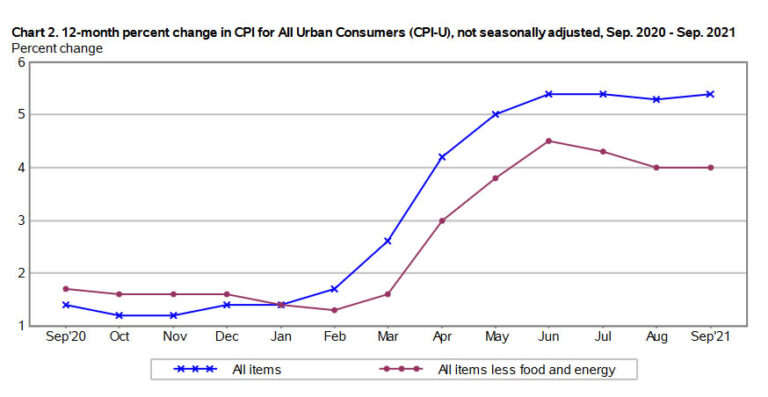

CPI outcome: Core Inflation Rate YoY unchanged 4% and Inflation Rate YoY 5.4% +0.1% more than expected.

Dollar index retreated to 94.1 with fear of inflationary pressures remained high in September helping the equities to rally US500 +0.28% USNDX+0.76%. FOMC showed that it is close to start tapering, possibly in mid-November with hike rates possible at late 2022 or early 2023.

As predicted, JPY rallied USDJPY: 113.28 -0.27 -0.24%

|

| Dollar index DXY |

No comments:

Post a Comment