Value investing is a tried-and-tested strategy that focuses on identifying stocks trading below their intrinsic value. One powerful tool for value investors is Value Line, a comprehensive investment research service that provides detailed analysis and recommendations for thousands of stocks. While a subscription to Value Line is a valuable resource for serious investors, you can often access this powerful tool for free! Most US libraries offer access to Value Line's database, either on-site or remotely with a valid library card. So, if you've ever visited a US library or have a current library card, you may already have access to this incredible resource.

In this blog post, we'll explore a simple stock screening approach using Value Line, highlighting four key criteria that can help you identify potentially undervalued stocks.

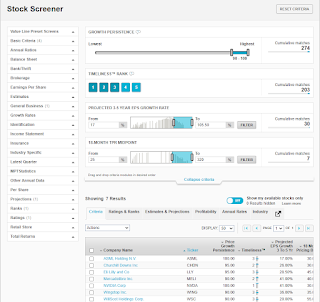

Key Screening Criteria

* Price Growth Persistence (PGP) of 90 or better: This filter focuses on stocks with consistent upward price movement, indicating a strong underlying trend.

* Timeliness Rank of 3 or better: The Timeliness Rank predicts a stock's relative performance over the next 6-12 months. A higher rank suggests a greater likelihood of outperforming its peers.

* 3 to 5-year EPS Growth of above 17%: This filter selects companies with robust earnings growth potential, a key indicator of long-term value.

* 18-month Target Price Range Midpoint of 25% or better: This criterion identifies stocks with significant upside potential, offering attractive returns for value investors.

Remember, this is just one approach to stock screening. You can customize these criteria or add additional filters to suit your individual investment objectives and risk tolerance.

A Deeper Dive into Value Line's Investment Research

While stock screeners are powerful tools for narrowing down investment opportunities, true value investing requires a deeper understanding of company fundamentals and market dynamics.

The Power of the P/E Ratio:

The Price-to-Earnings (P/E) ratio is a fundamental metric for assessing a company's value. A lower P/E often suggests a potentially undervalued stock, as you're paying less for each dollar of earnings. Value Line takes a unique approach to calculating P/E by incorporating both historical and projected earnings, providing a more comprehensive view of a company's true worth.

Understanding Value Line's Target Price Range:

Value Line's 3 to 5-year Target Price Range is a valuable tool for identifying stocks with significant upside potential. This long-term outlook aligns perfectly with the value investing philosophy of seeking undervalued companies poised for sustained growth. By focusing on the long-term potential, investors can avoid the pitfalls of short-term market fluctuations and make more informed decisions.

Staying Informed with Supplementary Reports:

These reports are published whenever significant developments occur with a company, ensuring that subscribers have the most current information readily available. This commitment to keeping investors informed helps them stay ahead of the curve and make informed decisions based on the latest developments.

Expanding Your Stock Screening Horizons:

There is a wide range of screening metrics beyond the basic criteria often used in initial screenings. Factors like financial strength, safety rankings, and recent price momentum can be incorporated to create a screening strategy that aligns with your individual investment goals and risk tolerance. By exploring these diverse metrics, you can tailor your stock selection process to your specific needs and preferences.

Tailoring Metrics to Specific Companies:

It's crucial to select relevant metrics based on the specific company and industry being analyzed. For example, traditional metrics like P/E might not be as informative for high-growth tech companies. By understanding the nuances of different industries and companies, you can choose the most appropriate metrics for your analysis.

Key Takeaways

* Value Line's research provides valuable insights into company fundamentals and market dynamics.

* The P/E ratio is a crucial valuation metric, but it should be considered in conjunction with other factors.

* Value Line's Target Price Range helps identify stocks with long-term growth potential.

* Supplementary Reports ensure that investors have access to the latest company developments.

* A wide range of screening criteria can be used to tailor stock selection to individual needs.

* The choice of metrics should be aligned with the specific characteristics of each company and industry.

|

| Screener Example |

No comments:

Post a Comment